Software's Metamorphosis

Winning The Upgrade Cycle

Software Synthesis analyses the evolution of software companies in the age of AI - from how they're built and scaled, to how they go to market and create enduring value. You can reach me at akash@earlybird.com.

Gradient Descending Roundtables

February 18: RL Environments with Scale AI

February 25: The Future of AI Compute

March 4: The Future of Software Engineering with Anthropic

Before Moltbook took over the internet this past weekend, the sell-off of public software companies reignited debates around the future of software.

Andrej Karpathy comments on recent advances in AI coding read ominously:

LLM agent capabilities (Claude & Codex especially) have crossed some kind of threshold of coherence around December 2025 and caused a phase shift in software engineering and closely related. The intelligence part suddenly feels quite a bit ahead of all the rest of it - integrations (tools, knowledge), the necessity for new organizational workflows, processes, diffusion more generally. 2026 is going to be a high energy year as the industry metabolizes the new capability.

The markets are spooked even as incumbents are crushing earnings estimates, as fundamental assumptions behind the quality of the software business model have come into question, as Jamin Ball wrote:

Mainly, confidence in the SaaS business model has shattered. SaaS businesses were long thought of as “cash flow annuities.” Loose money early on, flip profitable, and then every year print cash predictably. You could then calculate the “intrinsic value” of a SaaS business by summing the present value of every annual cash flow, with a terminal value assumption. More specifically, calculate the present value of the next 10 years of cash flows (discounted back to today), and make an assumption of the terminal value (ie year 11 onward).

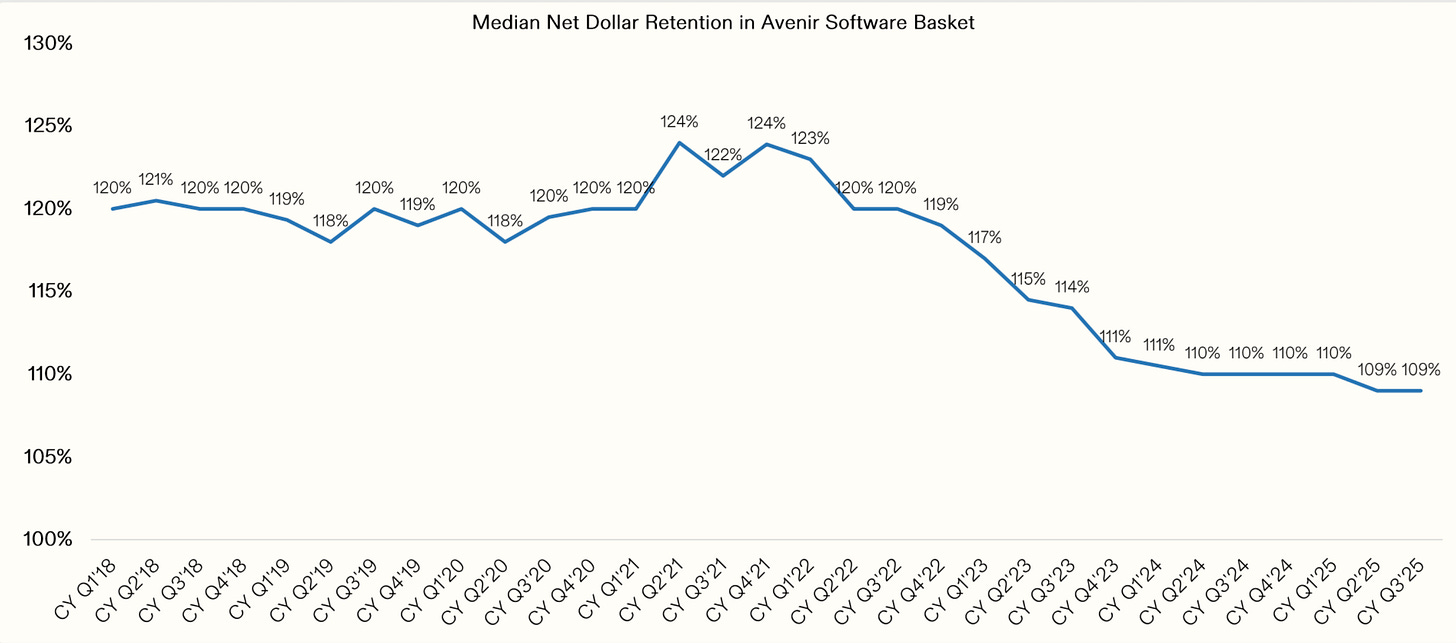

AI is creating huge questions about what the future retention rates of these “stable” software companies will be. Software bears will say this platform shift will lead to deteriorating retention rates as companies leave behind legacy SaaS vendors for modern AI native alternatives. At the same time (and related), this is increasing the probability that the terminal value is in fact 0 for some companies.

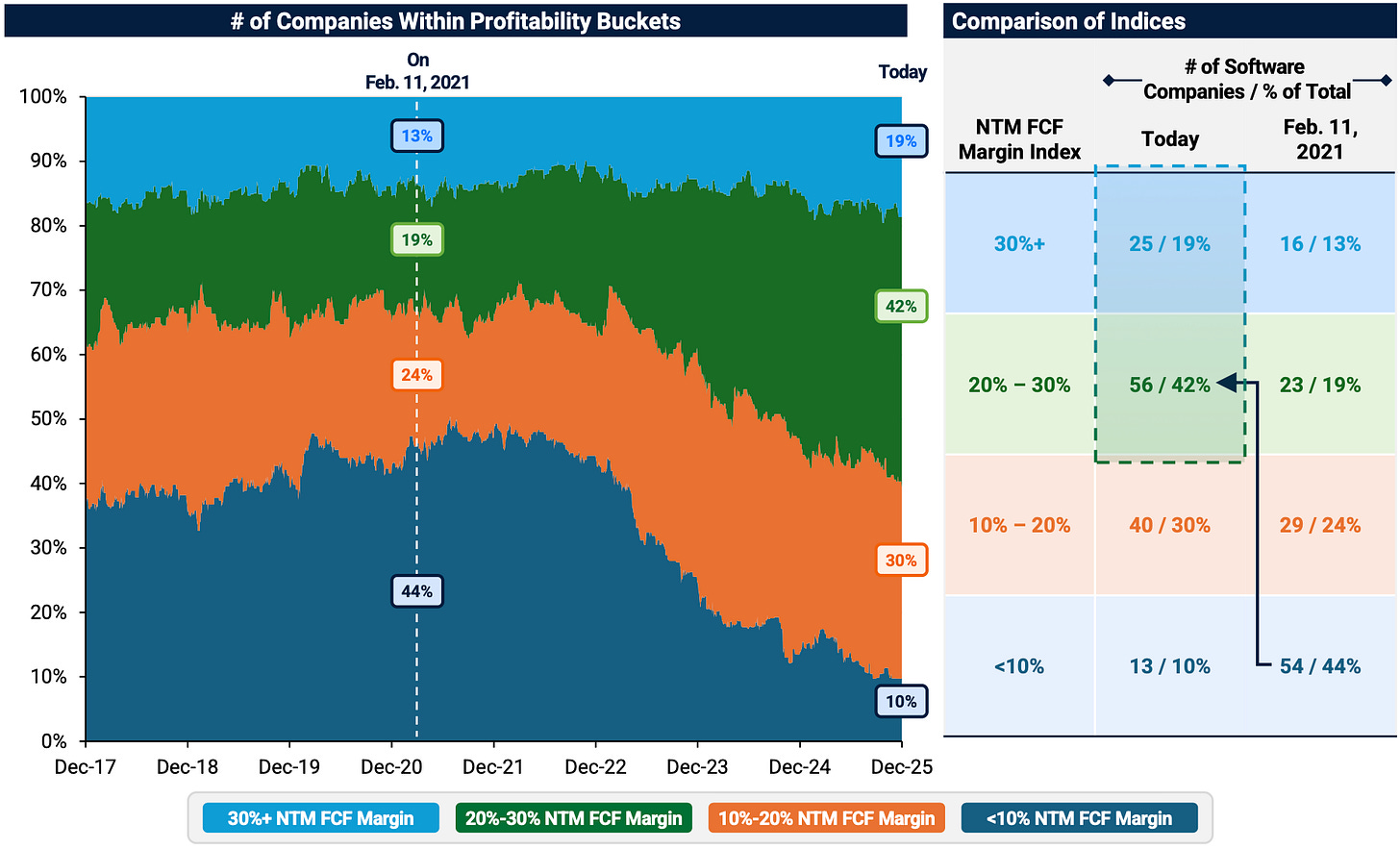

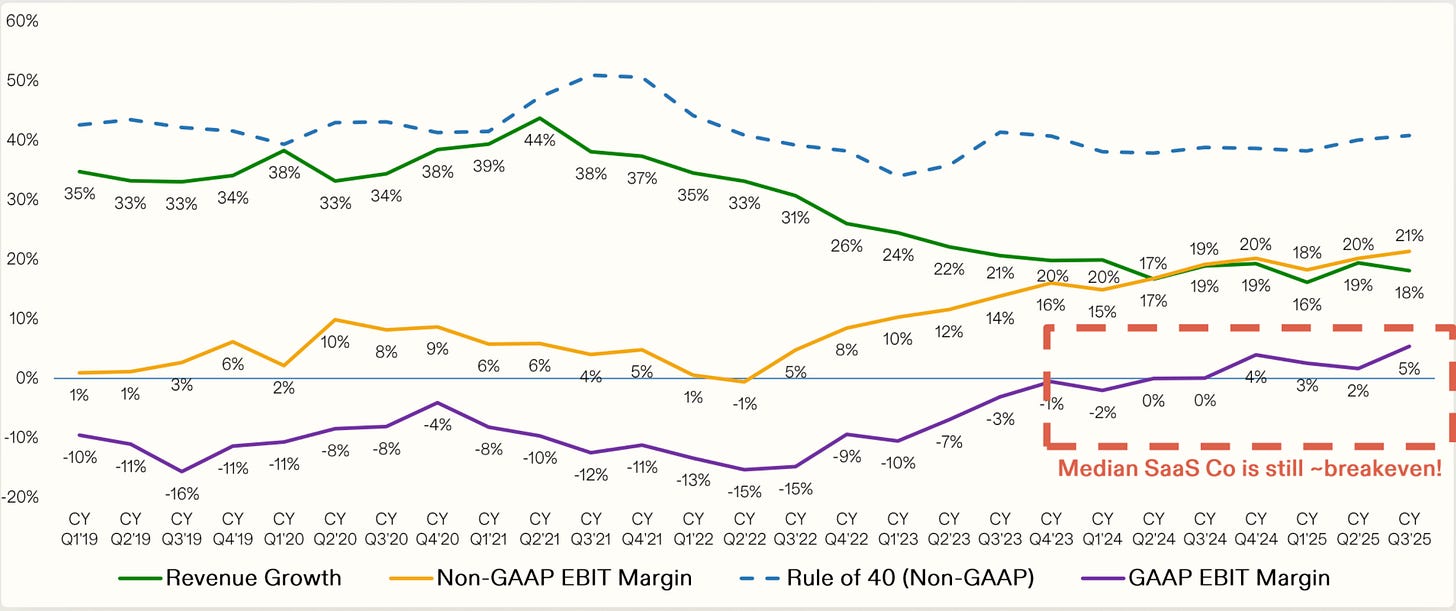

Retention has stabilised, having compressed from 2021 levels.

Software companies have become cash flow profitable, but this hasn’t translated to true economic profitability on a GAAP basis given the impact of stock-based compensation.

In light of this, there are three scenarios being debated, all against a backdrop of a potential historic upgrade cycle across the enterprise:

Incumbents infuse just enough AI across their product surface area, combined with their distribution advantages, to drive renewals

AI-native disruptors win the upgrade cycle and displace incumbents

Enterprises build their own applications/agents

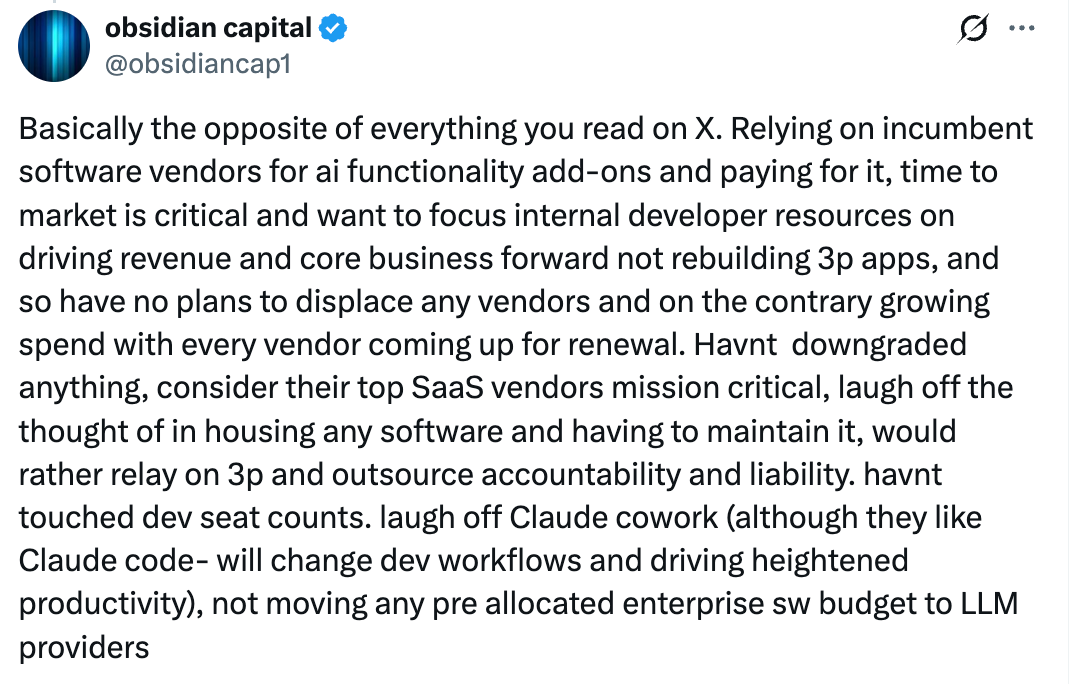

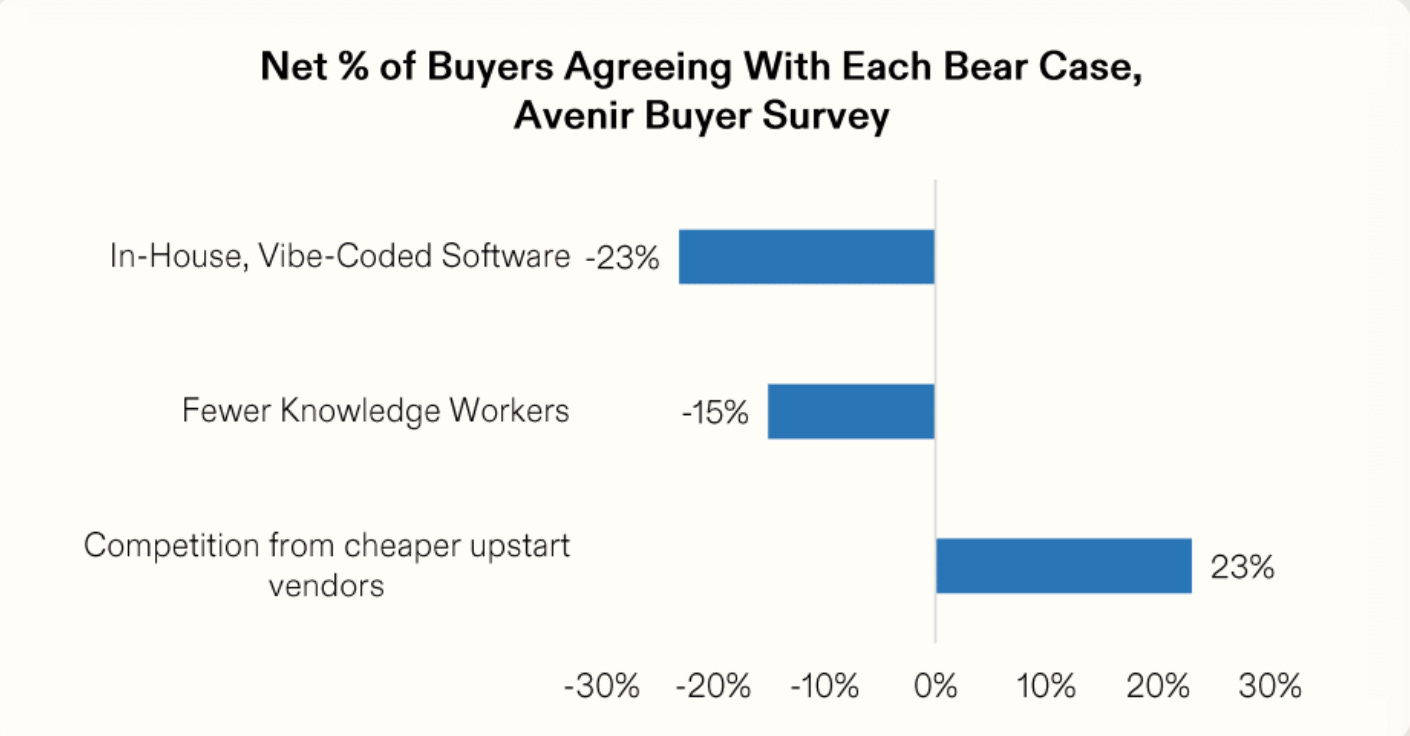

The most compelling argument against the latter is simple: focus.

Which leads me to the greatest irony of all: the companies that spend the most time and effort replacing SaaS with internal tools are the most likely to be disrupted. In business, nothing matters more than focus. The second you start expending engineering, product teams, and designers to reinvent the wheel, you’re distracting from your core competency, slowing everything and everyone down. Why do you think Netflix won the streaming wars? Why does Spotify lead in streaming music? Why does TSMC make all the chips in the world and not Intel? Focus. The best thing any business can do is invest time and effort in amplifying its own product offerings with AI. Replacing existing products to save negligible costs is a waste of time.

Followed closely by the delta in capabilities/total cost of ownership delivered by third-party vendors who are themselves singularly focused on their core product, versus software developed in-house.

SaaS is used because you get an exceptional product at extremely compelling financials; building it internally makes ZERO sense. The corporate version of Slack costs $18 per head per month. For a company of 1,000 people, you’re paying approximately $220,000 a year for Slack. $220K/year, which yields a proxy for roughly $75M in R&D effort annually. In other words, you’re earning a 340x amplifier for your money. SaaS has historically been an exceptional business because of how compelling the financials are for everyone. Slack is able to build an exceptional product because it focuses on one thing, their messaging app. Then they offer it at very compelling financial terms because they can leverage scale. It’s cheap for their customers while still highly profitable for them due to margins and scale.

JP Morgan’s internal tech team made similar remarks: AI is a TAM-expanding technology and the best use of incremental dollars is on the core business rather than rebuilding third-party apps.

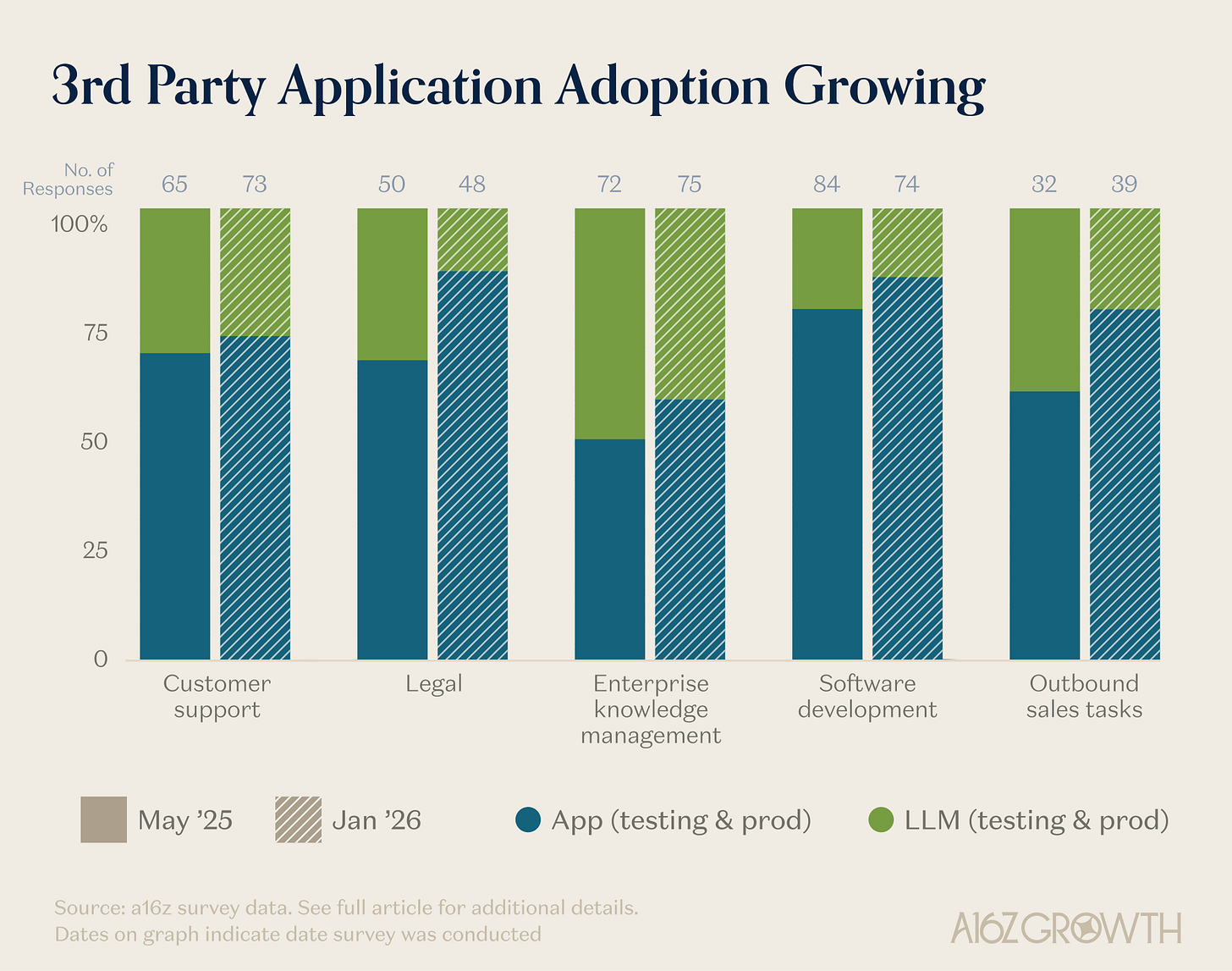

Recent surveys suggest this sentiment still holds true in the enterprise.

For now, at least, the upgrade cycle is going to be contested by incumbents and disruptors.

Klarna’s narrative in the run up to its IPO is instructive.

Staking its credentials as an AI-native company, the company decided to churn from Salesforce, among other SaaS apps, and consolidate around a graph database built on neo4j.

Sebastian Siematkowski’s explanation nearly one year ago was prescient:

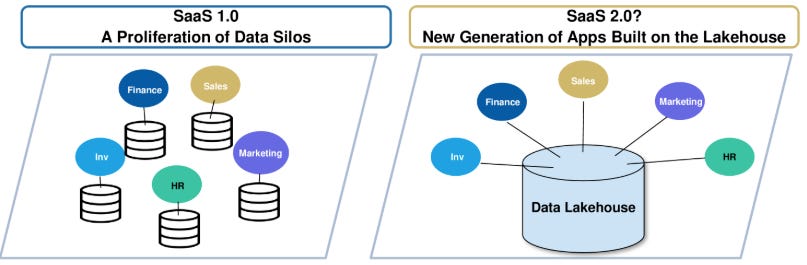

Key to our explorations became the conclusion that the utilization of SaaS to store all forms of knowledge of what Klarna is, why it exists (docs), what it tries to accomplish (slides, tickets, kanban boards), how it is doing (sheets, analytics), who is it dealing with (CRM, supplier management), who works here (ERP, HR) and what it has learnt was fragmented over these SaaS—most of them having their own ideas and concepts and creating an unnavigable web of knowledge that required a tremendous amount of Klarna specific expertise to operate and utilize.

Since then, incumbents have continued to erect walls around their data, and the concept of context graphs to collect company-specific decision traces has gone viral.

Directionally, it’s becoming clearer that enterprises want to remove silos and instrument the telemetry to capture decision traces that will enable agents.

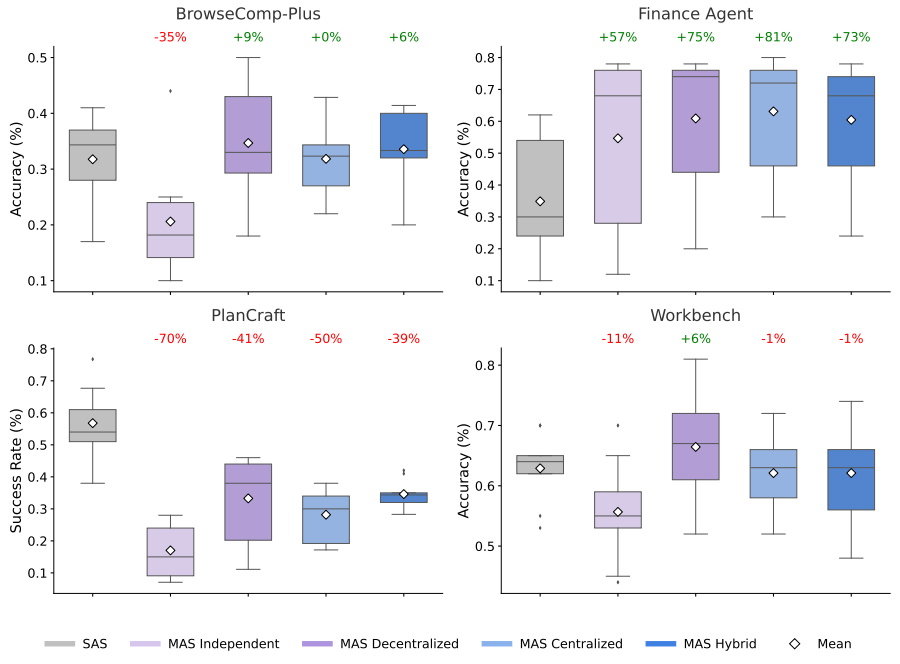

That future, one where stateful agents have freedom to operate across a company’s data estate, will reward vendors who are able to build the best harnesses around foundation models for their domain.

The best harness will translate to the strongest capabilities, and by extension the highest ROI. Support agents with the best harness will deliver the highest resolution rate. Coding agents with the best harness will have the highest throughput of PRs that get merged. Legal agents with the best harness will be faster, cheaper and more accurate at reviewing contracts.

Incumbents have the distribution, ecosystem, long-standing CIO relationships and platforms. The startups taking share away from incumbents are leaning into the future enterprises want and shipping 10x better products. The gulf has to be big enough to win this generational upgrade cycle.

A number of debates will be settled in coming years.

What’s the right UI for knowledge work in an agent-first world?

Will UIs optimise for the experience of agent delegation rather than humans doing the work?

We’re moving at warp speed. Buckle up.

Signals

What I’m Reading

Lessons from Building AI Agents for Financial Services

eating lobster souls Part III (the finale): Escape the Moltrix

Intel Earnings, The Agentic Opportunity, Intel’s Mistaken Pessimism

A Straussian reading of The Adolescence of Technology

Earnings Commentary

It’s almost like a religious war around where the value is created. Is it on the infrastructure layer which is currently the flavor of the month, where everybody is investing. By the way, that’s actually good for SAP because we are agnostic and the more money flowing into that, the more competitive that infrastructure will be to run our PaaS and SaaS services on top.

Dominik Asam, SAP CFO, Q4 2025 Earnings Call

The key metric we’re optimizing for is tokens per watt per dollar, which comes down to increasing utilization and decreasing TCO using silicon systems and software.”

Satya Nadella, Microsoft CEO, Q2 2026 Earnings Call

Have any feedback? Email me at akash@earlybird.com.