Notes On China

Breakneck, Five-Year Plans and Bubbles

Software Synthesis analyses the evolution of software companies in the age of AI - from how they're built and scaled, to how they go to market and create enduring value. You can reach me at akash@earlybird.com.

Events:

September 11th: Founder-led sales and structuring design partnerships with James Allgrove (ex Stripe)

September 14th: Hackathon, Beyond Context Limits: Building Enterprise-Grade AI

It's been a few weeks since my last post - one of the reasons for this is that I've been travelling through China for the last couple of weeks.

Today’s post is rather long, so here’s a preview of what we’re discussing:

The attention gap: Chinese companies lead globally in sectors from EVs to robotics, yet receive too little analysis in Western tech discourse

The engineering state: Government-directed investment and hypercompetitive domestic markets produce globally dominant companies at unprecedented scale and cost efficiency

Leadership contrast: Chinese government filled with engineers vs US political leadership dominated by lawyers since 1984, creating fundamentally different approaches to technological development

Historical parallels: China's approach mirrors the Manhattan Project and Apollo Program—state-coordinated "bubble-like" investment in physical infrastructure that creates lasting competitive advantages

Hypercompetitive selection: China's "thousand startups bloom" strategy creates hundreds of companies competing domestically, with winners achieving global leadership

AI deployment targets: China's "AI Plus" policy aims for 90% AI agent penetration by 2030, requiring massive state-driven upskilling efforts

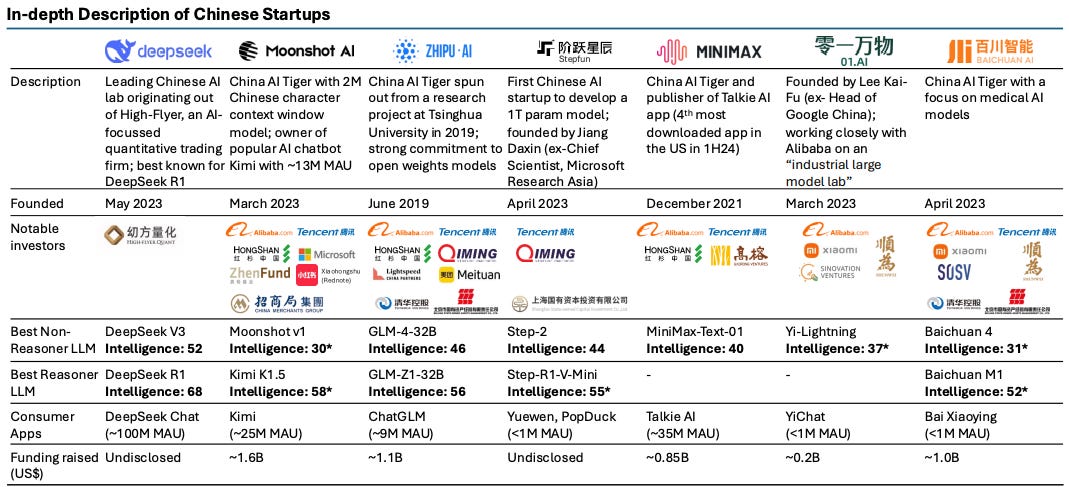

AI labs: Alibaba, Baidu, and ByteDance operate the world's largest consumer AI apps after ChatGPT, whilst a cohort of independent labs are delivering true innovations

Studying China

As Chinese companies have become world leaders in a number of sectors, I've been surprised by how little attention they receive in European/US tech discourse.

There's significant alpha to be captured in studying an ecosystem that's home to 50% of the world's AI researchers, the leading open-source AI labs, and category leaders across various sectors like energy, cars, drones and robotics.

It's worth tallying some of China's achievements in recent years:

In 2024, the United Nations Industrial Development Organization forecast that China will have 45 percent of the world’s industrial capacity by 2030. The United States, Europe, Japan, South Korea, Taiwan, and all other high-income states combined add up to 38 percent of capacity.

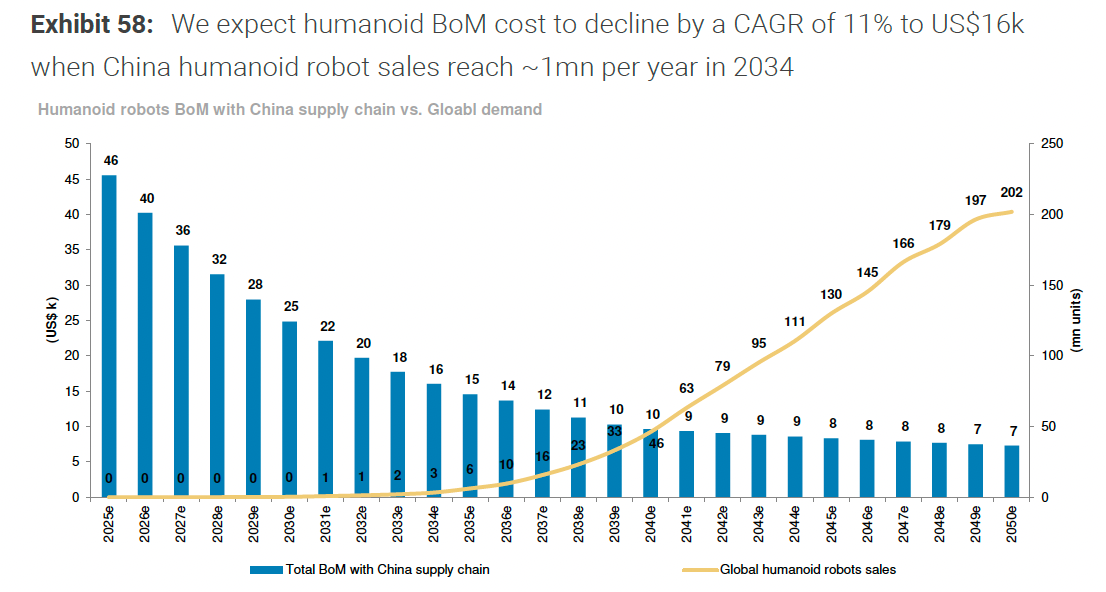

China currently represents 40% of the global robotics market (likely to increase). ~55% of robots globally are produced in China. Tesla Optimus BOM using a China supply chain is ~US$46k in 2025, expected to fall by CAGR of 11% to US $16k in 2034. This ~US$46k BOM cost from a China supply chain is roughly one third of the estimated BOM using a global (non-China) supply chain at US$131k in 2025.

Since 1980, after Deng Xiaoping’s reforms began, China has built an expanse of highways equal to twice the length of the US systems, a high-speed rail network twenty times more extensive than Japan’s, and almost as much solar and wind power capacity as the rest of the world put together.

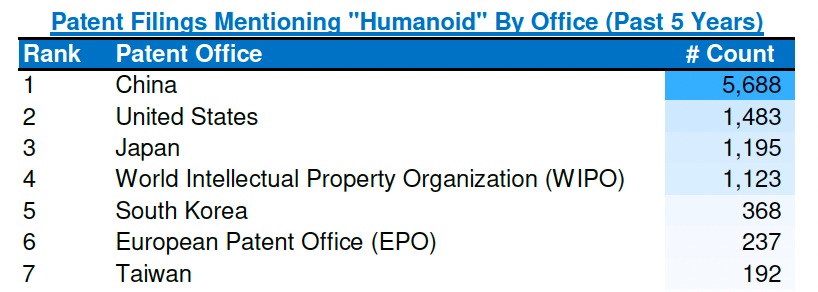

Today, China ranks #1 globally in AI patents and technology clusters, according to WIPO and R&D World. In humanoids, China filed 5,688 patents in the last 5 years - the US was a distant second with 1,483. China ranks first globally in terms of research papers on AI and the largest owner of AI patents worldwide since 2020 (especially in areas of voice and image recognition, robotics, and machine learning).

China's AI GPU self-sufficiency ratio is expected to rise from 34% in 2024 to 82% in 2027. The new V3.1 model of DeepSeek now supports a new precision parameter (UE8M0 FP8) specifically aimed at working with next-generation Chinese chips from companies like Huawei, Cambricon, and others.

China has two video platform giants – Bytedance and Kuaishou – which have around 80mn new videos generated per day, with the total length larger than that of YouTube.

As I spent time in Shanghai and Hangzhou, I was hoping to better understand the country's structural advantages and disadvantages. This was clearly just a surface-level exploration—there's overwhelming complexity and history that I have yet to grasp. This won’t be my last trip.

Even so, several observations from this first visit feel worth exploring. It just so happened that my trip coincided with Bill Gurley's own visit to China, which became the main topic of discussion on the recent BG2 episode.

Listening to Bill's observations on my flight back to London helped me process some of my own notes.

As he mentions on the podcast, Dan Wang's new book 'Breakneck: China's Quest to Engineer the Future' came out on the 26th of August, two days into my trip. I finished the book just before I returned to the UK and found myself constantly referencing Wang's insights in conversations throughout my trip.

Another book I kept thinking about during my trip was Byrne Hobart’s Boom: Bubbles and the End of Stagnation. The main premise of the book is that bubbles are a net positive - financial losses in the short-term are far outweighed by the long-term benefits of over-investment in infrastructure.

By generating positive feedback cycles of excessive enthusiasm and investment, certain financial bubbles mobilize the capital necessary to fund disruptive technologies at the frontier of innovation and accelerate breakthroughs in science, technology, and engineering. Crucially, such bubbles decouple investment from purely rational, backward-looking expectations of economic return, which correspondingly reduces risk aversion. Therein lies our escape from the Great Stagnation.

Hobart walks through the examples of the Manhattan Project and the Apollo Program as feats of technological and physical infrastructure buildout accomplished at unprecedented speed.

Take the Manhattan Project's parallelisation of infrastructure buildout:

One of the most impressive aspects of the Manhattan Project was its reliance on the assumption that other parts of the project would finish successfully. Take the uranium enrichment plant at Oak Ridge, which required an enormous amount of electricity to run and was designed to use an uncertain enrichment technique at scale. It was possible that the plant would not be able to produce uranium in sufficient quantity and purity to be useful in the atomic bomb. (Only a few years earlier, estimates of the amount of uranium an atomic bomb would require varied by an order of magnitude.)

Once completed, the plant would require electricity—in fact, it would require the single largest power plant ever constructed. Thus, a power plant was built for a facility that might not be able to produce uranium for a bomb that might not be viable for some unrelated reason. So what was, at the time, the world’s largest power plant was built for a facility that might not function at all.

The Apollo Program demonstrated similar breakthroughs in compressed timeframes:

When President John F. Kennedy declared in May 1961 that “this nation should commit itself to achieving the goal, before this decade is out, of landing a man on the Moon,” no one knew how to do it. 173 Rockets, launchpads, space suits, hardware, software, zero-gravity food—they didn’t exist, and there were no experts in these domains.

It wasn’t just that the space program lacked what was necessary to get to the Moon—scientists weren’t even sure it was possible. Engineering for space travel has obvious complexities, like getting a vehicle to the appropriate speed without threatening the safety of the crew. But there were non-obvious limitations, too: The tolerance for error is roughly zero, and the equipment and environment available on departure define the exact limits of what will be available until return. The scientists even worried that, if we did make it there, we might find chemically reactive Moon dust that would explode upon touchdown. Keep in mind that Kennedy made his announcement only four years after the first living creature was sent into space—Laika, a stray dog found on the streets of Moscow.'

Both projects spawned transformative technologies:

The Manhattan Project gave us nuclear power and a good reason to develop better rockets. And the Apollo program subsidized the early stages of the transistor, arguably leading to the modern computer revolution.

For the Apollo mission, NASA bought massive amounts of integrated circuits, which were used in the board computers of the Apollo command module and the Apollo lunar module. Indeed, NASA needed so many integrated circuits that, by the end of 1963, NASA purchased 60 percent of all integrated circuits manufactured in the US.

When MIT’s Instrumentation Lab, which oversaw the development of Apollo’s navigation and guidance system, bought its first integrated circuit samples, the bleeding-edge technology cost around $1,000 per unit (around $10,000 in 2022 dollars). However, MIT’s bulk purchase of integrated circuits for the Apollo program caused prices to drop significantly. By 1962, costs had fallen to $100 per microchip. A year later, MIT could order 3,000 integrated circuits from Fairchild Semiconductor for $15 per chip. Thanks to the space program, the cost of integrated circuits fell to $1.58 per chip by 1965. It’s therefore not surprising that Moore’s law was born during the Apollo period.

The state's ability to marshal enormous resources to achieve such ambitious goals was somewhat unique to the first half of the twentieth century, as Wang also concluded in his assessment of the US's transition away from an engineering state in the 1960s:

From the perspective of the 19th century or earlier, the 1930s was the decade of technocratic government operating at an unprecedented scale. Communism, fascism, and the New Deal obviously differed radically in their policy prescriptions and goals, but what they had in common compared to older systems was their ability and willingness to mobilize vast resources in service of the state’s goals.

These examples reveal important patterns about state-directed innovation.

First, government demand has historically enabled breakthrough technologies to reach scale. Without NASA's massive semiconductor purchases, the computer revolution might have been delayed by decades.

Secondly, narratives and beliefs play an important role in accomplishing technology breakthroughs.

Like the Apollo program, the Manhattan Project was suffused with religious symbolism and belief. The first atomic explosion and its test site were coded Trinity, and Oppenheimer confirmed that the term’s religious significance was intended.

Third, after these achievements in the world of atoms, Western technological progress increasingly shifted towards the world of bits

After the Manhattan Project and the Apollo program, whose major technological innovations—atomic bombs, nuclear energy, rockets, semiconductors—were largely physical, progress became increasingly confined to the virtual.

The Engineering State

And when I look at the world and I look out and I look at some of the largest problems in society that we're facing, almost all of them are atoms problems or at least have a significant component, which is real atoms and not just entirely done by bits. So as I look at the opportunity sets and the problems and where I hope the next generation set of entrepreneurs will focus, is on some of these tougher problems. Where you probably can leverage of course, digital tools and products, et cetera, where you also have to unlock some real scientific breakthroughs in atoms and climate change is an obvious one where we come into that.

Like Fairchild, the technology companies that defined the early days of Silicon Valley innovated at the intersection of “atoms” (hardware) and “bits” (software), a paradigm famously dubbed by MIT Media Lab co-founder Nicholas Negroponte. Businesses like Intel, Apple and NVIDIA solved hard scientific problems and made strides that fundamentally changed the world of technology.

The renaissance of businesses built at the intersection of bits and atoms plays to China's strengths as an engineering state, as Wang characterises it::

The starkest contrast between the two countries is the competition that will define the twenty-first century: an American elite, made up of mostly lawyers, excelling at obstruction, versus a Chinese technocratic class, made up of mostly engineers, that excels at construction.

The Atlantic's excerpt of Breakneck captures the main premise of the book:

Deng Xiaoping promoted engineers to the top ranks of China’s government throughout the 1980s and 1990s. By 2002, all nine members of the Politburo’s standing committee had trained as engineers.

Xi Jinping studied chemical engineering at Tsinghua, China’s top science university. For his third term as the Communist Party’s general secretary starting in 2022, Xi filled the Politburo with executives from the country’s aerospace and weapons ministries.

What do engineers like to do? Build. Since ancient times, the emperors have tried to tame the mighty rivers that sweep away not only farmland, but also imperial reigns. In modern times, new public works—roads, bridges, tunnels, dams, power plants, entire new cities—are the engineering state’s solution to any number of quandaries.

In contrast, in the US, from 1984 to 2020, every single Democratic presidential and vice-presidential nominee went to law school, while Republican leadership has followed similar patterns. Wang connects this lawyer-dominated culture to America's manufacturing decline, as legal and regulatory considerations increasingly constrained rapid industrial development.

One of Wang’s most vivid examples of the difference between the engineering state and lawyerly state is high speed rail. In 2008, California voters approved a high speed train linking San Francisco to LA, whilst China began working on a train connecting Beijing and Shanghai. Both lines would be around eight hundred miles long upon completion.

China opened the Beijing–Shanghai line in 2011 at a cost of $36 billion. In its first decade of operation, it completed 1.35 billion passenger trips.

California has built, seventeen years after the ballot proposition, a small stretch of rail to connect two cities in the Central Valley, neither of which are close to San Francisco or Los Angeles.

Or take energy.

In 1957, the world’s first commercial nuclear plant started producing electricity in Pennsylvania. In 1991, China's first commercial nuclear power plant started producing electricity.

By 2025, China caught up to the United States in the number of nuclear plants: fifty-five and fifty-four, respectively. Though the United States might restart a few decommissioned reactors, it has just one under construction. Meanwhile, thirty-one are under construction in China. The only US nuclear plant built in the twenty-first century took fifteen years and $30 billion.

The engineering state is very good at building. It's no wonder that during COVID, instead of stimulating consumption through cash payouts to consumers, China's solution was supply-side focused. Pursuing zero-COVID meant manufacturing could continue and layoffs would be avoided (China's trade surplus hit a record high in 2021/22).

China's manufacturing might was largely enabled by globalisation as American companies sought cheaper labour for contract manufacturing. 'Apple in China' documents Apple’s near-total dependence on Chinese production over the past two decades:

Apple itself estimates that since 2008 it has trained at least 28 million workers—more people than the entire labor force of California.

In 1999, none of Apple’s products were made in mainland China; by 2009, virtually all were. This rapid consolidation reflects a transfer of technology and know-how so consequential as to constitute a geopolitical event, like the fall of the Berlin Wall—but it’s an event that played out over many years, hidden by the twin threats of strict nondisclosure agreements and a censored media landscape where all the action was.

The CHIPS and Science Act, which is designed to stimulate computer chip fabrication in America, will cost the US government $52 billion over four years—$3 billion shy of what Apple invested annually in China nearly a decade earlier. Let me underscore this point: Apple’s investments in China, every year for the past decade, are at least quadruple the amount the US commerce secretary considered a once-in-a-generation investment.

Today, Apple works with more than 1,500 suppliers in fifty countries. But all roads lead through China: 90 percent of all production occurs in the country, and its much-vaunted assembly operations in Vietnam and India are no less dependent on the China-centric supply chain.

These numbers underline the role Apple played in Shenzhen's rise as a global electronics and manufacturing hub, as Wang writes:

In 1980, when Deng Xiaoping christened Shenzhen a “special economic zone,” the city had little to recommend it other than its location directly abutting British-ruled Hong Kong.

By the 2000s, Shenzhen was a major electronics hub. The workforce would become the spearhead for the greatest business endeavor of the early twentieth century: the campaign to put a smartphone into the hands of nearly everyone on the planet.

When Steve Jobs announced the iPhone in 2007, there was no more natural place than Shenzhen for mass production. It had already scaled up manufacturing of the iPod there a few years earlier. Apple decided that Shenzhen was the city to make the boldest product that Jobs had conceived.

At peak times, Foxconn's Shenzhen campus had three hundred thousand people. Foxconn, who had refined electronic contract manufacturing, together with Apple's own team who'd frequently visit Shenzhen, helped turn Shenzhen into the 'Silicon Valley of hardware', becoming the home of BYD, DJI and Huawei, among others. The process knowledge accumulated in Shenzhen has permeated all kinds of hardware.

The magic of Shenzhen is the combination of the world’s most creative hardware engineers sitting in a sea of components that improve every year amid a labor force of millions who know how to put together electronics. This buzzing ecosystem has produced many other products that follow in Apple’s wake, like hoverboards, electric scooters, virtual reality headsets, and who knows what’s next?

During my trip, I was amazed by the quality (and price) of the cars - all the taxis I hailed on DiDi were electric. You can tell a car is electric if the license plate is tinted green - to my eye, these were the majority in Shanghai and Hangzhou.

What's more, the internal software in these vehicles was as impressive as any I'd seen in the West - BYD cars were especially slick on this front. BMW made a big announcement last week about their new lineup of EVs that supposedly surpass Chinese rivals and make software the biggest driver of value, built on their 'Neue Klasse' platform. Despite the impressive metrics unveiled, the reality remains that China produces EVs at far lower cost, and BMW still relies on China's CATL to develop new batteries.

Jim Farley, CEO of Ford, has been driving a Xiaomi SU7 for the past few months and described it as the ‘the most humbling thing I have ever seen’ and rated the cost and quality of the vehicles ‘is far superior to what I see in the West’, adding that 'executing to a Chinese standard is now going to be the most important priority.'

Western carmakers have good reason to be worried about Chinese carmakers because they represent the winners of brutal domestic competition.

Bill Gurley has talked about China's strategy of letting a 'thousand startups bloom' previously on BG2, whereby the state implemented a series of startup-friendly policies after the global financial crisis, investing in hundreds of companies in strategic sectors like energy, EVs, AI, and semiconductors, letting market forces pick winners. This approach echoes Hobart's argument that transformative progress requires massive, seemingly irrational investment that transcends purely rational economic calculations.

Wang elaborates on this dynamic in Breakneck: provinces and cities heavily subsidise local champions, creating intense competition among hundreds of companies—China has over 100 car brands alone. The survivors excel across multiple dimensions: supply chain optimization, manufacturing automation, software development, and battery technology. This creates a virtuous cycle where scale drives down costs, establishing both domestic and international market leadership.

Reverence for science and technology leadership dates back to the Qing dynasty which lost the Opium Wars and were forced to sign the Nanjing Treaty (ceding Hong Kong, opening up ports to the British, among other concessions):

Every Chinese leader since the Qing emperors who lost the Opium Wars has felt aggrieved about falling behind in technology. Maintaining an industrial base is the best guarantee that China won’t lose again. This thread runs through China’s modern leaders, from Nationalist Sun Yat-sen, his protégé Chiang Kai-shek, and then the Communist rulers too. Deng Xiaoping launched his great project to unshackle China from socialism by appealing to the Four Modernizations: agriculture, industry, defense, and science and technology.

There are several examples of how the state has actively played a role in China's rise.

Hangzhou exemplifies this state support. Home to the '6 little dragons'—five leading AI companies (BrainCo, Deep Robotics, DeepSeek, ManyCore, and Unitree Robotics) plus game developer Game Science—the city provides startups with tax breaks, subsidies, and computing infrastructure. Hangzhou allocates 15 percent of its annual fiscal revenue to tech investments and actively nurtures talent from Zhejiang University, whose alumni founded four of these six companies, providing housing and stipends to attract top researchers.

US Commerce Secretary Howard Lutnick's comments on the US lifting export restrictions on Nvidia's H20 chips prompted Beijing to double down harder on weaning the Chinese AI ecosystem Nvidia. Regulators had already been actively encouraging China's fledgling AI ecosystem to use alternatives like Huawei's Ascend chips, which have already been used by DeepSeek for inference, whilst ByteDance and Ant Group are exploring training on them.

In recent months, another vendor has gained prominence: Cambricon.

Cambricon, founded in 2016, has seen the rising tide of domestic demand lift its revenue 43x YoY. Cambricon served Huawei in its first few years before pivoting away to compete directly with Huawei once they had churned. Cambricon addresses some of the shortcomings of the Ascend chips, e.g. a CUDA alternative in Cambricon Neuware. Another tailwind that flew under the radar was DeepSeek's choice of UE8M0 FP8 as a data format for their newest V3.1 model, as Kevin Xu explained. This was significant because it marked the beginning of potential standardisation of the Chinese AI stack around this format. Cambricon supports FP8, whilst Huawei will likely support it in future releases.

Adding all this up, UE8M0 FP8 as a scale factor gives AI GPUs that are produced from less advanced processes (e.g. 5nm or 7nm) with less memory attached and less bandwidth interconnecting all the pieces a chance to punch above their weight. In other words, whatever SMIC is capable of at this moment, if it could scale up to volume production, might be enough!

In order to foster more competition with Huawei, Beijing has instructed Chinese foundry SMIC to set aside a larger portion of its capacity for Cambricon.

As Intel takes on investment from the US government, China's doing its level best to close the gap with Nvidia. Another tailwind for Cambricon and Huawei is Nvidia's diminishing value proposition around energy efficiency.

If AI companies are ultimately limited by power then they must maximize performance per watt; as long as Nvidia leads in that specific metric, their sky-high prices are well worth paying.

Power, however, is much less likely to be a limiting factor in China than in the West; that, by extension, means that Nvidia’s moat is much more dependent on CUDA, but that depends on China actually building on Nvidia chips. Huang’s long-term fear is that China is one of the most important countries for AI chips in the long run, and that Nvidia has no sustainable differentiation even if they were free to sell.

China's Five-Year Plans are a cornerstone of its central planning system, providing a blueprint for economic development and setting national priorities. The Fourteenth Five-Year Plan, published in 2021, embodies the same ambitious mentality that Hobart argues drives breakthrough innovation—outlining projects that would have seemed like science fiction not long ago:

We will perform basic scientific research on the origin and evolution of the universe, carry out interstellar exploration such as Mars orbiting and asteroid inspection.

We will construct hard X-ray free-electron laser devices, high-altitude cosmic ray observation stations, comprehensive extreme condition experimental devices, deep underground cutting-edge physical experimental facilities with very low background radiation.

Another policy blueprint that was key to the acceleration of internet adoption in China was the 'Internet Plus' strategy published in 2015, which preceded the rapid diffusion of WeChat Pay and Alipay across China. A new 'AI Plus' policy paper was released at the end of August, outlining even more ambitious targets for AI diffusion:

By 2027. Achieve broad and deep AI integration in six key fields. New-generation intelligent terminals and AI agents should have a usage rate of over 70%, and the size of the intelligent economy’s core industries should grow rapidly.

By 2030. Penetration of intelligent terminals and AI agents will exceed 90%, and the intelligent economy will become a major growth driver of China’s economy.

Delivering on these targets of AI penetration will require large-scale, concerted efforts to upskill the population. The kinds of state-driven mobilisation that few modern countries are capable of, as we discussed earlier.

China's not alone in pursuing technological transcendence, of course. Stargate is an infrastructure project of the kind of scale that the US hasn't aspired to for many years. The US is also home to the world's leading AI labs, whilst Tesla, SpaceX, Anduril and other companies point to a revival of US manufacturing prowess. Both the Biden and Trump administrations have sought to reshore manufacturing in different ways (the CHIPS Act, IRA, tariffs), but China's ascent in the world of atoms seems unassailable.

As Bill Gurley suggested and as some economists are starting to argue, the best course of action might well be to acknowledge Chinese leadership in certain industries and pursue JVs with Chinese companies to enable technology transfer, just as China did a couple of decades ago.

Software and 0→1 innovation

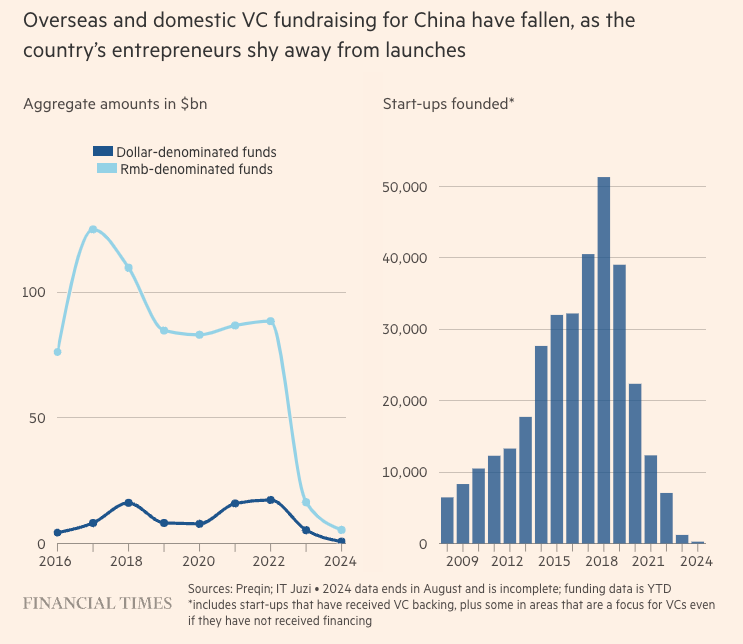

Beijing's scrutiny of certain sectors of its tech ecosystem in recent years has undoubtedly impacted the ecosystem at large.

As Wang explains:

On a 2023 inspection tour through Jiangsu province (like Guangdong, a manufacturing powerhouse), Xi said, “The real economy is the foundation of a country’s economy, the fundamental source of wealth creation, and an important pillar of national strength.”37 It is the basis, he continued, of “human production, life, and development.”

He has repeatedly said that China needs to prioritize the real economy, which means the world of manufactured products, rather than the virtual or financial economy, sometimes referred to in state media as the “fictitious” economy.38 State-affiliated researchers commonly denounce financialization with the hollowing out of manufacturing in the same breath.

Another reason for this change in posture was the growing influence of China's consumer internet giants, like Alibaba, ByteDance and others, posing a potential threat to the state's power.

In any case, despite these recent changes, there’s a lot to learn.

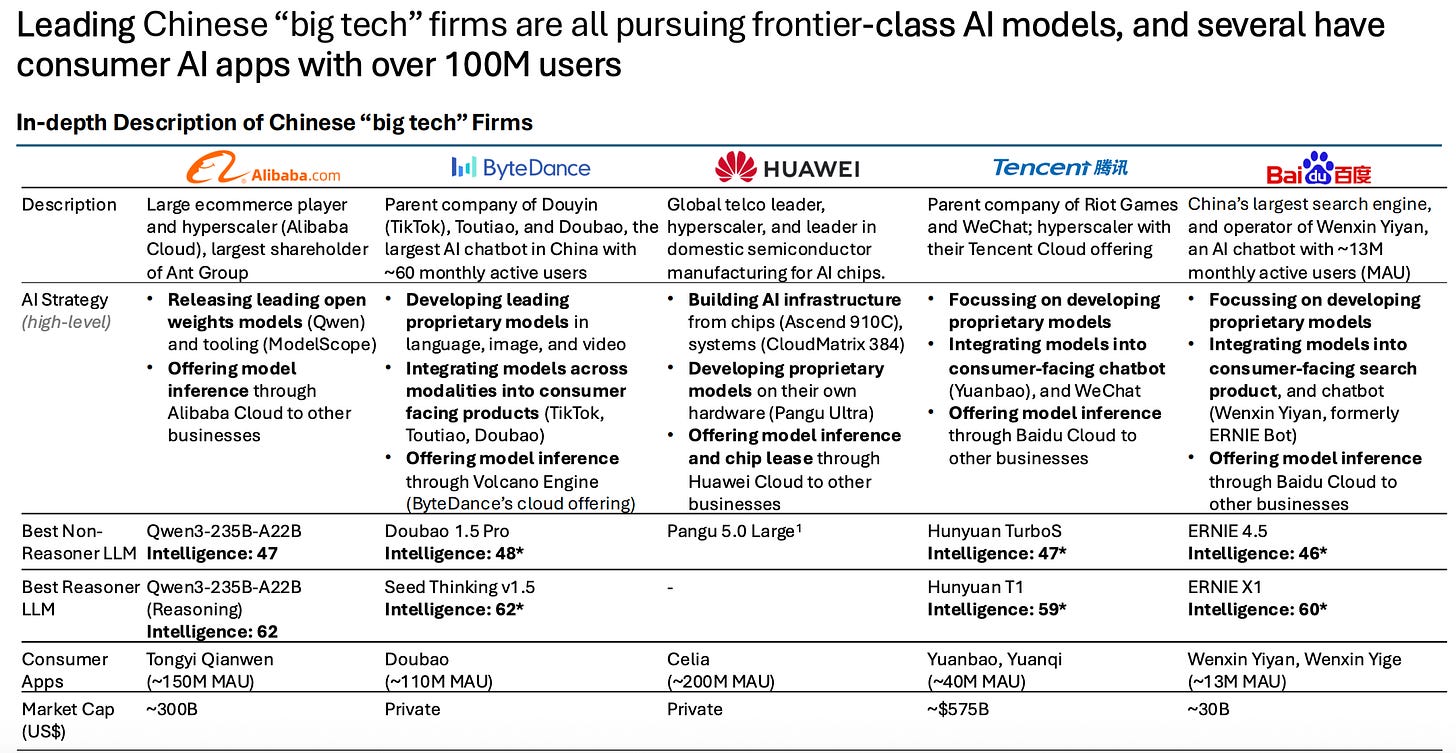

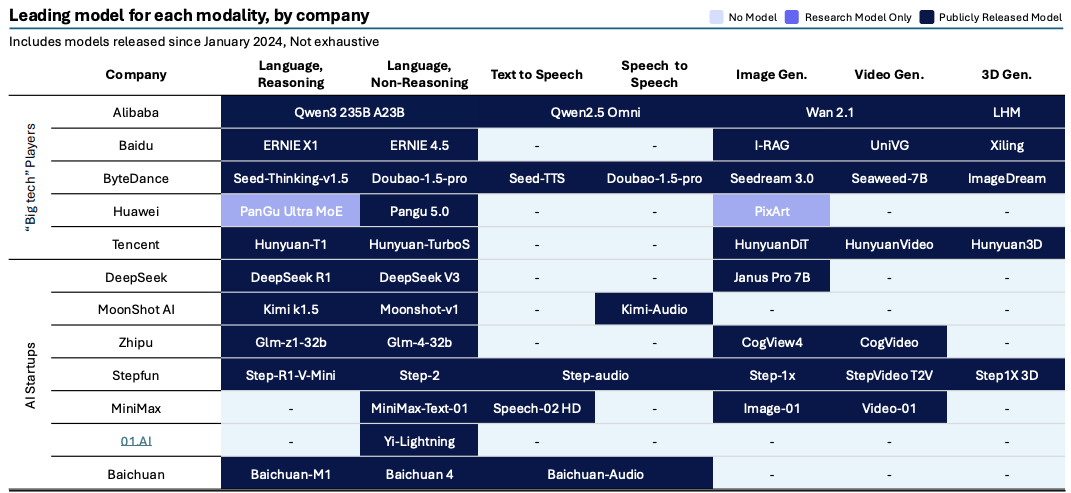

To start, China is home to the world's largest consumer AI apps after ChatGPT, with each of the internet giants having a horse in the race:

Numbers 2, 3 and 4 are AI assistants from Alibaba, Baidu and ByteDance, respectively.

Doubao, ByteDance's multimodal AI assistant (text, image, video, voice, and 3D) processes trillions of tokens but remains free for consumers.

ByteDance has launched a range of products built on its foundation models, as it also designs custom ASICs together with Broadcom:

ByteDance in many ways combines the different strengths of US giants.

Like Meta, ByteDance doesn't have to monetise its foundation models because the capex is more than offset by performance gains in its core recommendation engines across TikTok.

Like Google, it's a full-stack company from chips to applications.

Like Microsoft and Amazon, ByteDance can commoditise foundation models as part of its cloud offering for enterprises.

Its Seed research team is an umbrella group focused on frontier AI research, much like Meta's recently assembled Superintelligence Lab.

In addition to China's Big Tech firms, there's a cohort of new AI labs, led by DeepSeek, that have been making headlines with true innovation, especially in areas like model efficiency, RL environments, and edge AI.

Critics often question whether China can achieve true 0-to-1 innovation or fundamental scientific breakthroughs. Wang counters that similar regimes have produced Nobel Prize-winning research, while Chinese AI labs increasingly deliver genuinely novel architectural improvements. Whether the next post-transformer breakthrough will emerge from China or the US remains an open question. Nevertheless, Chinese academic researchers enjoy abundant funding, and major AI labs are aggressively recruiting top talent.

Once a breakthrough is realised, scaling up production to capitalise on economies of scale is one of China's clearest strengths, as my friend Axel wrote:

Once foundational models plateau, China’s edge shifts into gear. Its strengths are in turning good tech into great infrastructure: fast deployment, tight feedback loops, and massive market integration. That’s where the real advantage lies.

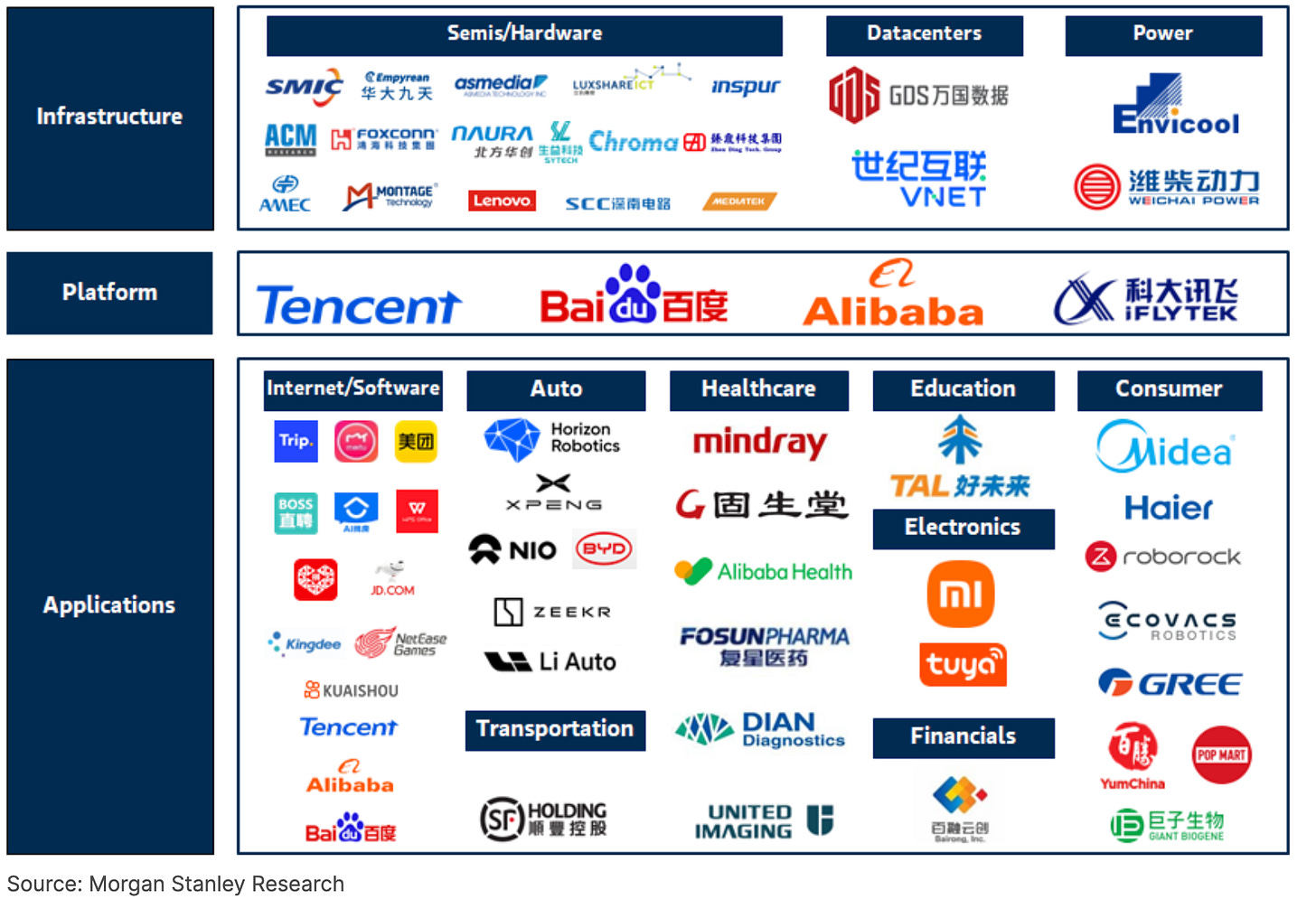

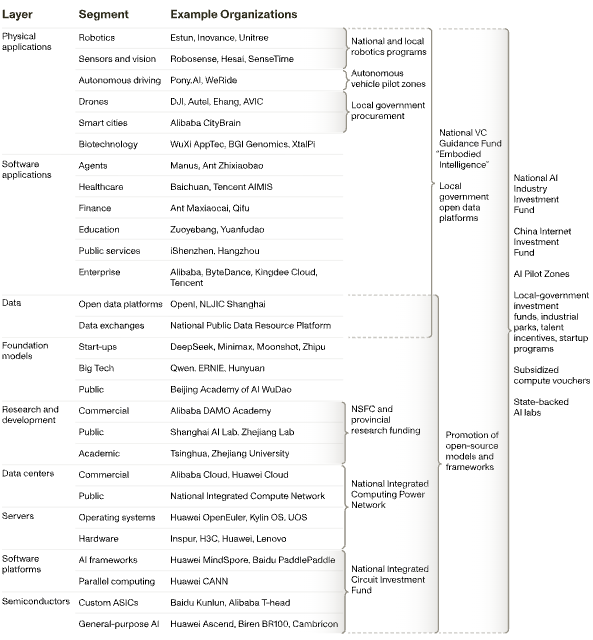

As things stand, a full-stack ecosystem is already emerging in China.

Closing thoughts

I visited China with an open, curious mind. Being based in Europe, I tend to think that a multi-polar world is inevitable and that we should accordingly learn more about China's rise and its antecedents.

For all of the benefits of the engineering state I mentioned, there are of course downsides, as Wang covers in the book (the enforcement of zero-covid being the most recent example).

China's engineering-first approach has many flaws, but there are specific capabilities worth studying and combining with a country's incumbent advantages.

These observations reflect a single trip and ongoing learning. The reality is undoubtedly more nuanced than any brief visit can capture. I'm certain future visits will reveal layers of complexity I've missed, and I welcome feedback from those with deeper experience in China.

Further Reading

A future history of China in the 2020s

From Sputnik to Supply Chains: China's AI Vision

Will this be the Chinese Century?

Ranking the Chinese Open Model Builders

China's Structural Advantage in Open Source AI

ByteDance’s AI Legacy and Strategy: Doubao, Volcano Engine and Beyond

Data

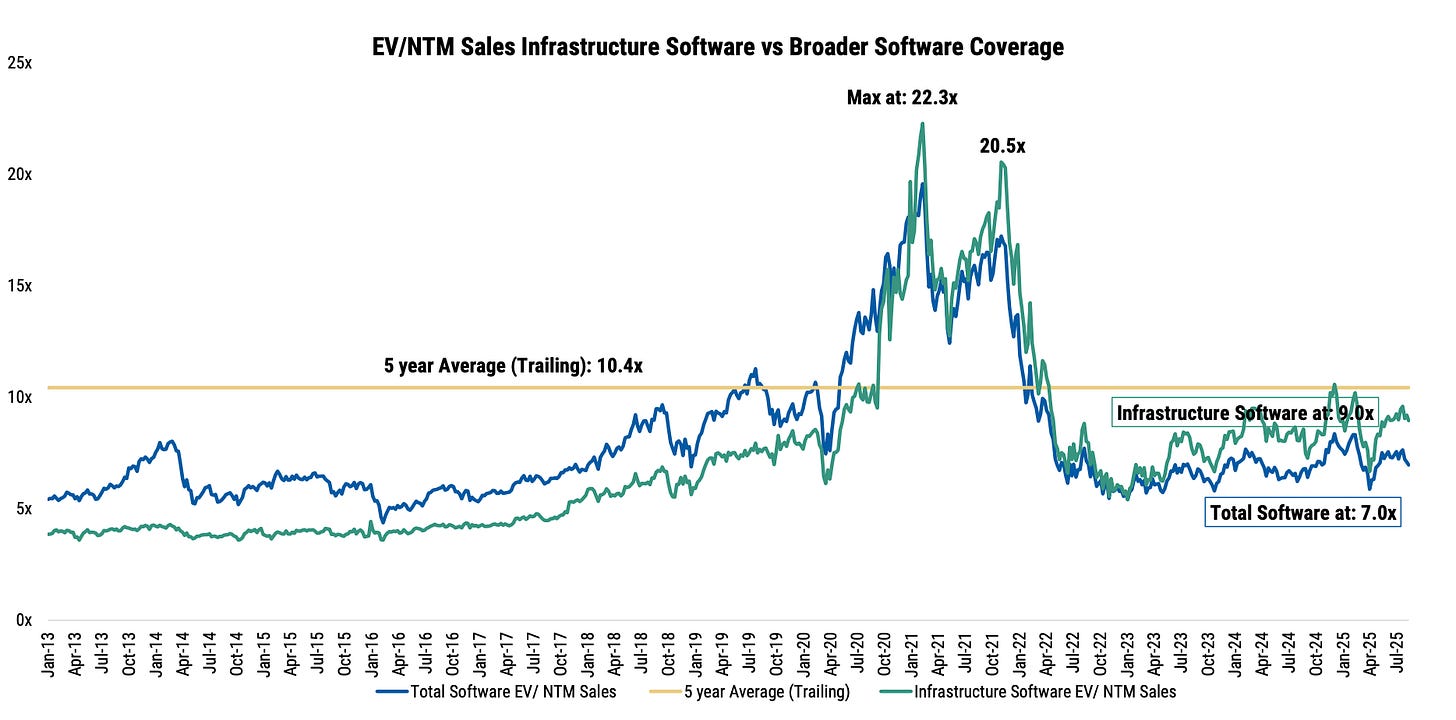

Infrastructure software multiples have expanded recently but remain below 5 year average

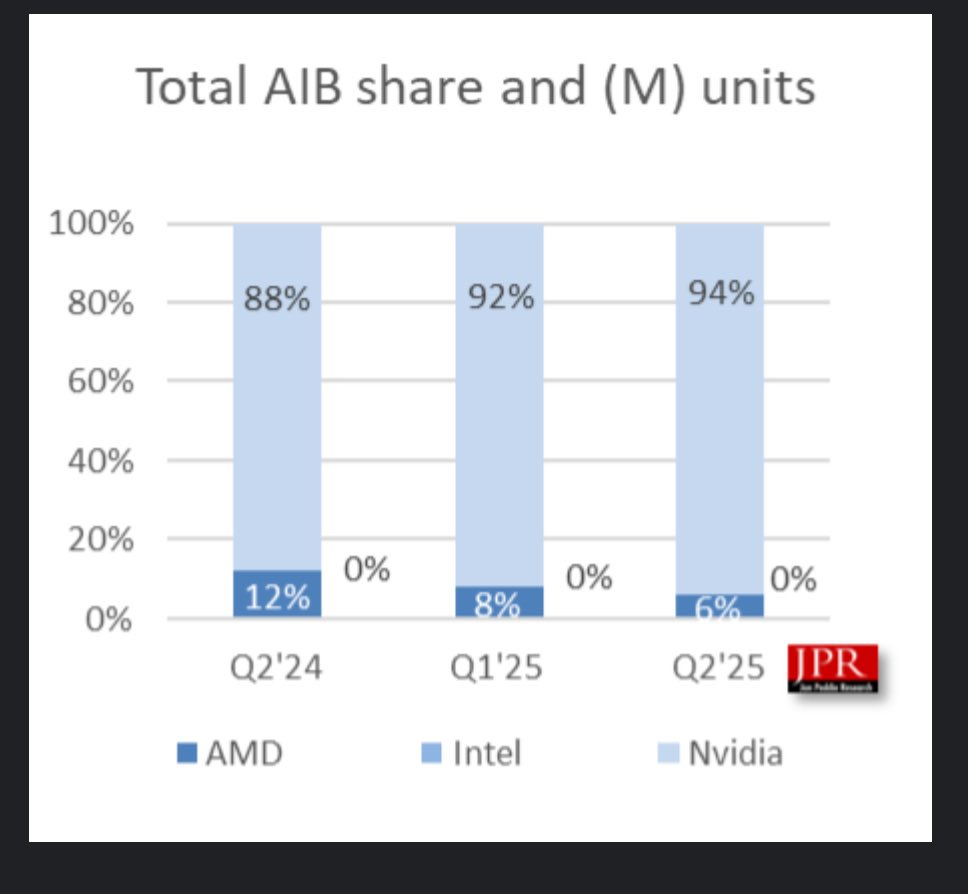

Nvidia market share is increasing

China’s AI 60 per Morgan Stanley

Have any feedback? Email me at akash@earlybird.com.